CIRO-managed agents restrict the brand new leverage (lent finance) you can use whenever trading CFDs. Business also needs to gauge the viability out of CFDs to have clients, that could encompass requesting your own exchange experience and comprehension of economic locations one which just initiate. Looking to change ascending and shedding financial locations including Canadian brings while you are turbocharging your results which have a tiny bills? Contracts to have difference, otherwise CFDs, are a go-to help you choice for of many Canadian investors.

Places – brua

Such will set you back can reduce earnings otherwise increase losses through the years if they may not be precisely accounted for. CFD trading now offers profit prospective, but it also deal a premier risk of loss. An array of unstable issues, in addition to economic reports, political situations, and you may market sentiment, dictate financial segments. As the traders is also imagine on the both ascending and you will dropping cost, they have the flexibility to respond to a variety of business requirements. CFD exchange is going to be successful, particularly if segments move around in the newest individual’s rather have and you may positions try handled very carefully.

Key Features of CFDs:

Within the CFD exchange, merchandise assist investors speculate to your price actions of numerous possessions, in addition to brua metals, time points, agricultural issues, and you can commercial gold and silver coins. Exchange merchandise lets traders to help you diversify the profiles and take advantage of around the world have and you will consult figure. CFDs provide a flexible directory of fundamental possessions, for example holds, indicator, currencies, merchandise, and cryptocurrencies, to possess people to choose from. Per CFD classification boasts their unique provides and trade criteria. Hence, people should comprehend the root asset’s essentials and you may technical research ahead of entering CFD exchange so you can decrease dangers.

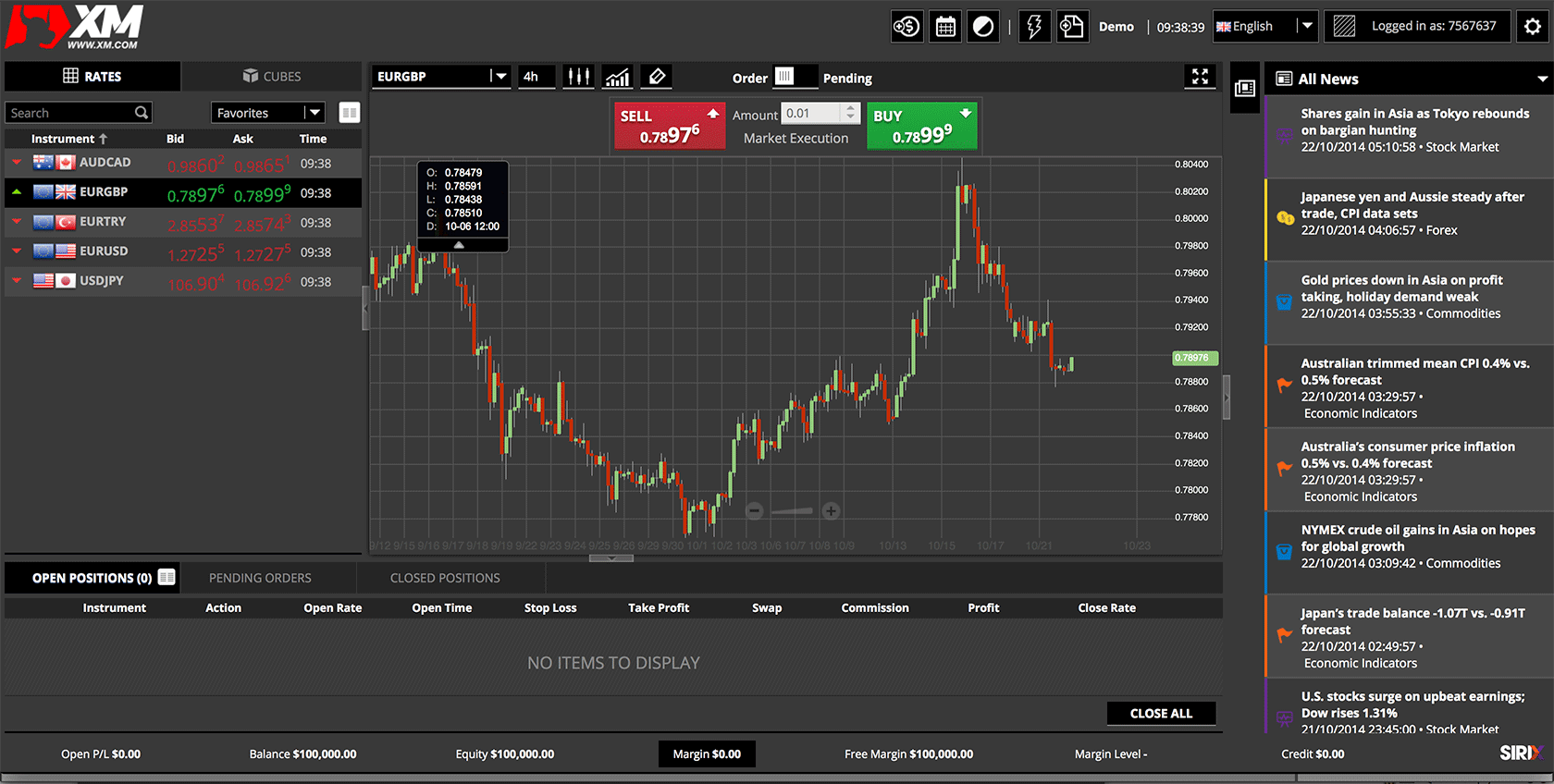

The change from the property value your position shows motions within the the root field. You can monitor all your opportunities to your trade platform, and you can romantic him or her by clicking the new ‘close’ switch. For those who unsealed your role by buying, you could potentially close by selling the same quantity of deals from the the fresh offer speed – and you will vice versa. CFDs enable it to be buyers to help you without difficulty bring a lengthy otherwise brief condition otherwise a purchase and sell position.

As an alternative, a position are closed by the placing a swap contrary to your the one that exposed they. A purchase reputation out of five-hundred silver deals, for instance, might possibly be closed from the selling 500 gold deals. Should this happen, you can aquire a great margin phone call from your own agent requesting to best enhance account. For individuals who don’t create enough financing, the career is generally closed, and you can people loss sustained might possibly be understood. The fresh ‘spread’ is the gap amongst the higher speed an industry pays for your considering resource, and also the cheapest price people holding the fresh resource will actually sell at the. That it pit ensures that once you promote of the right position, the price demonstrated on your exchange system won’t end up being the accurate rate your sell for.

There are two main form of margin just be used to when exchange CFD shares. Money.com is actually a flexible and you can scalable solution, regardless of your own exposure urges, experience or even the sum of money you must exchange. Including, if you wish to place an order to own $step 1,000-value of Brent rough petroleum plus broker needs 10% away from margin, you need just $a hundred since the first amount to discover the newest trade. That have bank-levels security measures, in addition to a few-foundation authentication and you may detachment target whitelisting, PrimeXBT implies that profiles is trading with full confidence knowing its property are well protected.

Change CFDs try a relatively rates-efficient way to engage the brand new derivative places because it boasts affordable income, if any. Nevertheless, it is best to get aquainted most abundant in prevalent costs to stop any offensive unexpected situations later. BestBrokers.com will provide you with a good walkthrough of the very popular charge you can also be invited whenever trade CFDs on line.

They mean that you can manage the danger and you will return for the your own investments without the need to observe a display the complete time. After closing-out our very own change, our bucks balance increases from the €613 to €10,613, and you can all of our business coverage drops to help you zero. Pepperstone will give united states which have a first harmony out of €10,100 inside the digital financing. We’ll routine trade exposure-free with that up until we become one thing doing work precisely. We really do not give taxation information, but i’ve included specific details right here to guide you.

Sure, you are able to trade CFDs enough time-label using the reputation trade strategy/build. Yet not, it might be worth noting one to even after this plan/style, really people remain its ranking open just for two months and you can, inside the unusual instances, around per year. Various other main idea of risk administration relates to having fun with a stop-losses order to guard your situation if the field movements against your. Based on your method and exposure management bundle, you could use about three different varieties of prevent-losses sales. Generally, very investors won’t chance more than 1-2% of their money per trading, which coincides along with your exposure-to-award proportion. It proportion states how much your’re ready to risk compared to the potential cash you could potentially want to make.

Variation in the CFD Trade

You opt to pull out ten CFD agreements for the Team A great’s inventory, that’s really worth $250 for every share. The difference between both beliefs might possibly be either your own profit or your own loss, depending on how you choose to go into the deal. You need to consult a different and you can appropriately registered monetary coach and make certain that you have the chance appetite, associated knowledge and experience before you trade. Using leverage requires a top quantity of engagement, because it’s advisable to display their positions frequently.

Correlation is very important, measuring the partnership involving the rates moves of the two assets. The two assets must be people who are often very coordinated but i have come to getting reduced coordinated. Whether or not CFD trading is actually regulated in certain jurisdictions, the level of manage differs by the jurisdiction. To guarantee equitable and discover trade points, people is to work with managed brokers. Boost your experience of individuals advantage versions to profit out of CFD agents. This could increase exposure administration and avoid dependence on an individual advantage.

They’re able to are different based on should your exchange are small or enough time, and on which asset you’re also exchange. Constantly, a broker usually listing these types of charges on their site, to help you account for this cost beforehand. When you go into a good CFD, both you and an agent commit to replace the difference between an asset’s rates after you unlock the fresh trading and also the resource’s rate once you personal the brand new change. “Small promoting,” otherwise “heading quick,” is a habit enabling buyers whom accept that a valuable asset is overvalued, to start a situation that can acquire a return on the enjoy your instrument’s rates decreases. Specific financing points, and CFDs, depend on other financial possessions.

Property which are traded while the CFDs tend to be stocks, indicator, commodities, currencies (forex), and you can cryptocurrencies. CFDs allow it to be investors to speculate to your price moves of these hidden assets rather than in fact getting her or him, providing possible payouts out of both ascending and you can shedding locations. To close out, CFD exchange is actually a type of by-product exchange that enables buyers to speculate to your speed actions from a wide range of underlying possessions, rather than in reality getting the brand new assets by themselves. However, CFD exchange relates to a premier quantity of exposure, and you will people should know the risks inside it ahead of exchange. Investors also needs to choose a reputable CFD agent, which have lowest transaction will cost you and you may a person-amicable trade program, to ensure a confident change sense.

An opening sell condition can be placed if the a trader believes you to definitely a security’s rate tend to refuse. Again, the internet differences of your own obtain or losings try dollars-paid as a result of its account. The customer will give their carrying for sale should the customer out of a good CFD comprehend the asset’s speed rise.